Len Weiser-Varon specializes in the structuring, documentation, disclosure and tax and legal compliance aspects of financial transactions and programs involving state entities, including qualified tuition programs under Section 529 of the Internal Revenue Code (Section 529 college savings plans), qualified ABLE programs under Section 529A of the Internal Revenue Code and state-sponsored IRA programs. He represents state issuers as well as private program managers and other contractors.

Len was previously a member (partner) within the public finance section of a Boston-based national law firm, where he practiced for 39 years and was responsible for the firm's state-sponsored savings plan practice. Len has written extensively on public finance and state-sponsored savings program topics in industry publications and blogs. He has represented trade groups and government entities in interactions with the U.S. Treasury Department, Internal Revenue Service, SEC and state agencies involved with rule-making and compliance matters.

Len also has decades of experience with municipal bond transactions as bond counsel, underwriters' counsel, trustee's counsel, borrower's counsel, purchasers' counsel and bondholders' counsel, as well as with a wide spectrum of service contracts and other contracts with or by public entities.

In his practice, Len values timeliness and efficiency in attending to client needs.

Len is a graduate of Dartmouth College and Columbia Law School, where he was a member of the Columbia Law Review. He clerked on the Supreme Judicial Court of Massachusetts.

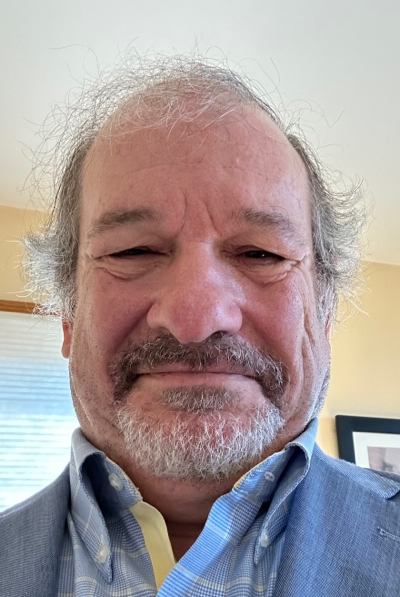

Len Weiser-Varon

tel. 781-267-5606

email: lwv@weislawyering.com